Comprehensive Guide to Solana Architecture

Discover the Sovereign Validator standard. A deep dive into Solana's architecture, Proof of History, and why bare-metal infrastructure is critical for security.

Executive Summary

- The Paradigm Shift: Solana validators differ fundamentally from Bitcoin miners; they act as cryptographic chronometers using Proof of History (PoH), not just puzzle solvers.

- Infrastructure Criticality: Virtualized cloud environments introduce "jitter" fatal to Solana's 400ms block times. Institutional-grade "Sovereign Validators" require bare-metal servers with kernel-bypass networking.

- Economic Darwinism: With the potential acceleration of disinflation (SIMD-0411), only operationally efficient validators with sustainable reinvestment strategies will survive.

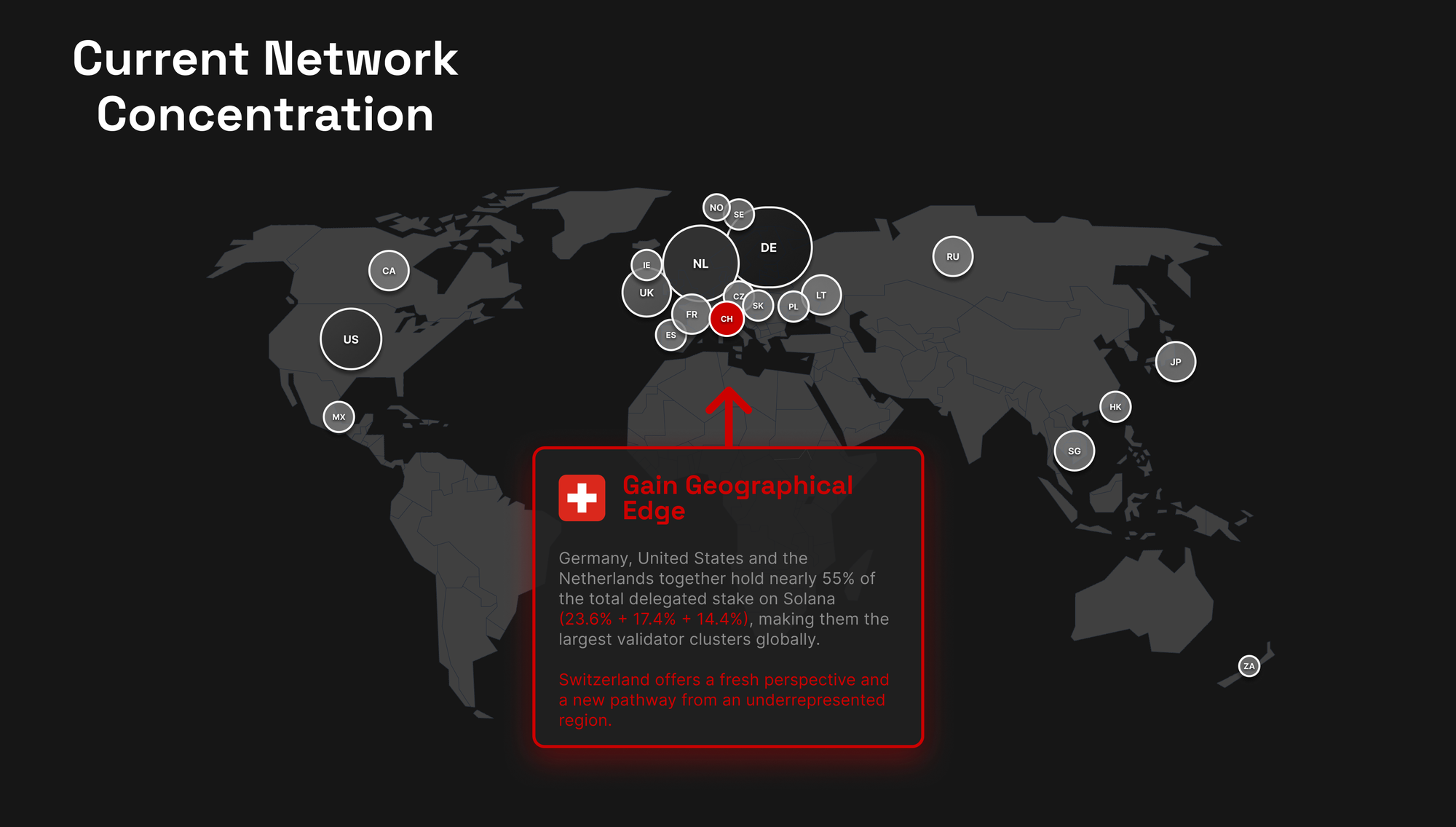

- Geopolitical Strategy: "Jurisdictional Arbitrage" is now a key component of network security. Switzerland offers a neutral, regulated ground (DLT Law) that protects against OFAC censorship and data seizure.

The Evolution of Trust and State

The concept of the blockchain validator has evolved from a passive participant in a decentralized network to a sophisticated, institutional-grade operation. In the early days of distributed ledger technology, validation was synonymous with mining, a probabilistic race largely dependent on raw computational brute force.

However, the advent of Solana and its unique Proof of History (PoH) mechanism has redefined this paradigm. A Solana validator is a chronometer, a cryptographic notary, and a high-frequency trading engine rolled into one. It is the fundamental atomic unit of truth in a global state machine operating at the speed of light.

As the network matures, a new archetype is emerging: the Sovereign Validator. Unlike hobbyist nodes or cloud-rented setups, this entity is characterized by an uncompromising adherence to bare-metal infrastructure, a strategic commitment to jurisdictional neutrality, and a dedication to long-term ecosystem health.

The Physics of Consensus

The primary differentiator of a Solana validator lies in how it perceives time. Without a central clock, distributed nodes struggle to agree on the order of events, leading to latency. Solana solves this through Proof of History (PoH), a cryptographic mechanism that allows validators to create a verifiable passage of time before consensus is reached.

Proof of History: The Chronometer

PoH is not a consensus mechanism; it is a pre-consensus clock. A validator executes a high-frequency Verifiable Delay Function (VDF) running a continuous SHA-256 loop where the output of the current iteration becomes the input of the next:

This process is inherently sequential and cannot be parallelized, proving that real time has passed between two events. When a validator acts as a Leader, it injects transactions into this stream, effectively timestamping them with microsecond-level resolution.

For a validator, this architecture changes operational requirements from stochastic (Bitcoin) to deterministic. The network creates a Leader Schedule one epoch in advance, assigning specific 400ms slots to specific validators. This determinism allows for optimization but places an immense burden on the validator to be perfectly synchronized. A drift of even a few milliseconds risks missed slots and lost rewards.

The Verification Asymmetry: While generation requires a single core, verification can be parallelized across multiple cores. This asymmetry is hard to generate, easy to verify, central to Solana's scalability.

Tower BFT: The Consensus Layer

Once PoH establishes the order of events, validators utilize Tower BFT (a variation of PBFT optimized for PoH) to agree on validity. Unlike chatty"traditional PBFT, Tower BFT leverages the PoH clock to reduce communication overhead, allowing validators to vote with cryptographic timeouts encoded directly into the vote.

Voting is an economic commitment. When a validator votes, it locks a portion of its stake on that specific fork. This lockout period doubles exponentially with every subsequent vote (hence "Tower"). Voting on a conflicting fork while locked results in slashing and the destruction of stake.

Operationally, this means voting is a continuous stream of financial transactions. With a 400ms slot time, a validator participates in consensus roughly 216,000 times a day. This incurs a baseline cost of ~2–3 SOL per epoch, creating a financial hurdle that filters out non-serious participants.

Engineering for Speed: Turbine and Gulf Stream

The Turbine Propagation Protocol

Transmitting a 100MB block to 2,000 validators individually is impossible. Solana addresses this with Turbine, a protocol inspired by BitTorrent. The Leader breaks blocks into shreds and transmits them to a neighborhood"of validators, who re-transmit them to others.

However, Turbine makes packet loss catastrophic. If a validator has poor connectivity or is throttled by a cloud provider, it misses shreds and cannot reconstruct the block. This necessitates sovereign infrastructure with unmetered, 10Gbps+ connections, 25Gbps suggested. The SPDR validator, for example, utilizes high-grade network peering to ensure it sits at the top of the Turbine hierarchy, minimizing propagation delays.

Gulf Stream: The Mempool-less Future

Solana eliminates the traditional mempool via Gulf Stream. Because the Leader Schedule is known in advance, validators forward incoming transactions directly to upcoming leaders. This reduces confirmation latency but bombards the validator with transaction ingress.

A validator must verify and forward tens of thousands of packets per second without choking. This requires a Transaction Processing Unit (TPU) optimized for UDP traffic, distinct from standard web server TCP/IP. This requirement drives the shift away from virtualized cloud environments, which struggle with high-volume UDP processing due to hypervisor overhead.

Infrastructure Strategy: The Bare-Metal Imperative

The theoretical elegance of Solana is meaningless without institutional-grade hardware. The choice between Cloud infrastructure and Bare-Metal servers is the single most critical strategic decision a validator makes.

The Failure of the Cloud Model

For a high-frequency Solana validator, the public cloud is a liability due to the "Noisy Neighbor" problem. Cloud instances share physical resources, managed by a hypervisor.

- Jitter: If another tenant experiences a traffic spike, the validator’s access to CPU caches is delayed. In Solana's 400ms slots, a 50ms delay is fatal.

- Packet Overhead: Virtualized network interfaces introduce software interrupts and context switches, adding latency to every vote.

- Cost: Data egress fees on cloud providers (for ~100TB/month) destroy profit margins.

The Sovereign Solution: Bare-Metal Architecture

Top-tier validators like SPDR utilize Bare Metal: single-tenant physical machines. This allows for:

- Kernel Bypass (XDP/eBPF): Processing packets directly at the network driver level, bypassing the OS stack to handle DDoS attacks and Gulf Stream traffic.

- CPU Pinning: Isolating the PoH generation thread on a specific 5.0 GHz+ core to prevent OS interruptions.

- NUMA Awareness: Ensuring the validator process uses memory physically attached to the executing CPU socket to shave nanoseconds off latency.

The result is deterministic performance: a flat latency curve, higher vote credits, and a 0% skip rate.

Hardware Specifications for the 2026 Era

As of 2025, the baseline for a sovereign validator has shifted. The ecosystem favors AMD EPYC (Threadripper) processors for their superior AVX-512 instruction set support and high core density, crucial for the verification pipeline. DDR5 memory is now standard to provide the bandwidth necessary to feed these cores from the Accounts database.

Economic Engine: Incentives and Sustainability

Running a validator is a business. The economic model aligns validator incentives with network security, but it is subject to intense Darwinian pressure.

The Inflationary Squeeze (SIMD-0411)

Solana pays for security through protocol inflation, which is scheduled to decrease by 15% annually until it hits 1.5%. However, the SIMD-0411 proposal seeks to double this disinflation rate to 30%.

While this supports token value by reducing supply, it represents a massive revenue cut for validators. Estimates suggest that 5% of the current validator set, specifically smaller, rented nodes, would become unprofitable. In this environment, only validators with owned bare-metal hardware and optimized cost structures will survive. The Sovereign Validator model is a hedge against this economic tightening.

Maximal Extractable Value (MEV)

As inflation rewards decline, validators turn to MEV, profit made by ordering transactions. With ~90% of the network running the Jito-Solana client, validators conduct out-of-protocol auctions where traders bid for transaction inclusion.

Sovereign validators distinguish themselves through Ethical Extraction. Instead of maximizing profit via predatory sandwich attacks, validators like SPDR employ integrated MEV protection to ensure they remain profitable without exploiting their delegators.

The Reinvestment Flywheel

The "0% Commission" tactic is often a trap, leading to hardware degradation. A sustainable model involves a fair commission (e.g., 5%) coupled with transparent reinvestment. SPDR, for instance, reinvests revenue into Swiss-precision hardware upgrades, creating a flywheel: Better Hardware → 0% Skip Rate → More Stake → More Revenue → Better Hardware.

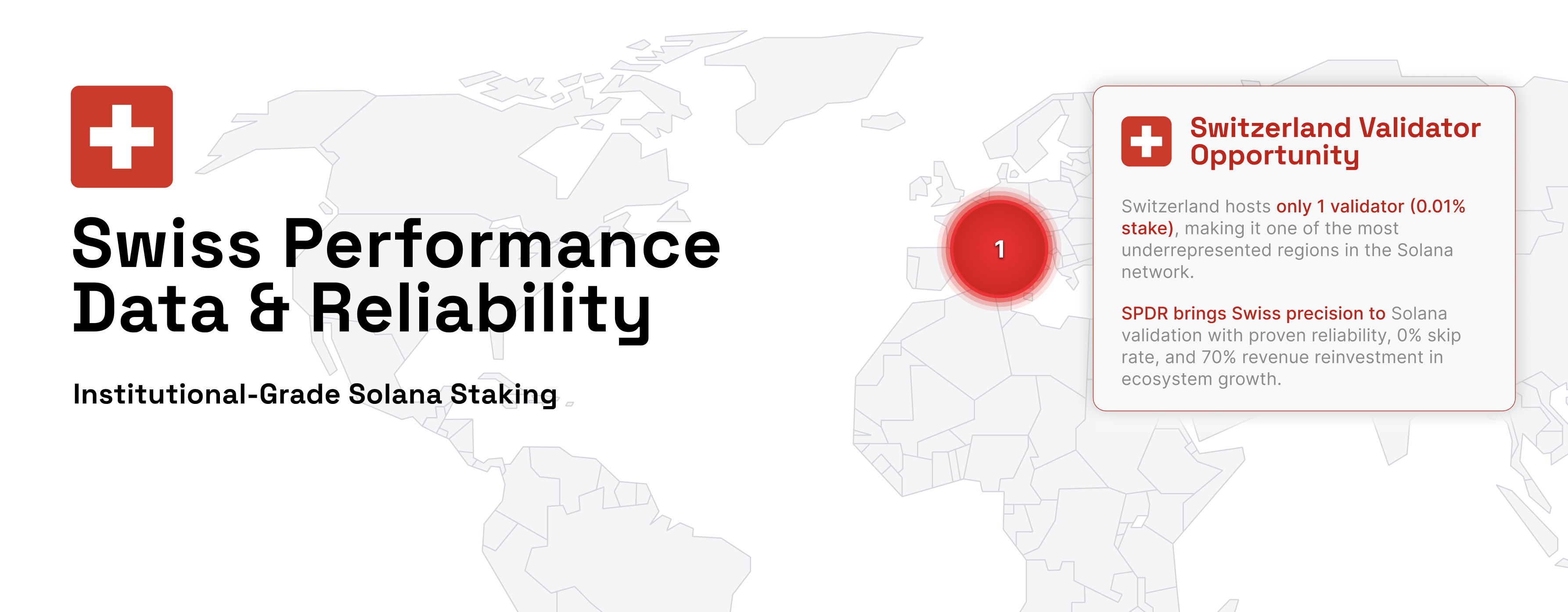

The Geopolitics of Validation: The Swiss Advantage

In the blockchain world, physical jurisdiction creates risk. Currently, a disproportionate amount of Solana’s stake is hosted in the US and Germany, presenting vectors for censorship (OFAC compliance) or data seizure.

Switzerland: The Neutral Ground

To counter this, the Sovereign Validator emphasizes Jurisdictional Arbitrage. Switzerland has emerged as the ideal neutral ground.

- Legal Clarity: The Swiss "DLT Law" provides clear regulatory frameworks, recognizing crypto assets as distinct legal entities.

- Neutrality: Non-EEA status insulates Swiss-based validators from EU or US regulatory overreach.

The SPDR Case Study

The SPDR validator explicitly leverages this advantage. By locating bare-metal infrastructure in the Swiss Alps bunker-graded data fortresses. it offers a sovereign solution that diversifies the network's jurisdictional footprint. Staking with a Swiss validator is a vote for decentralization and political resilience.

The Sovereign Validator Standard

The question "What is a Solana Validator?" has a multi-layered answer.

- Technically, it is a high-frequency VDF engine that enforces a global clock (PoH) and participates in a rapid-fire voting protocol (Tower BFT).

- Operationally, it is a transition from virtualized cloud instances to optimized, single-tenant bare-metal infrastructure, capable of handling gigabits of UDP traffic with zero jitter.

- Economically, it is a business navigating the headwinds of disinflation (SIMD-0411) and the opportunities of MEV, requiring a sustainable commission model to fund continuous reinvestment.

- Geopolitically, it is a strategic asset that must be shielded from regulatory overreach through jurisdictional neutrality.

The convergence of these factors points to a new standard: The Sovereign Validator. This standard is characterized by the refusal to compromise on hardware (Bare Metal), the refusal to compromise on location (Neutral Jurisdictions like Switzerland), and the refusal to compromise on performance (0% Skip Rate).

The SPDR Validator serves as a paradigmatic example of this new breed. By offering a bare-metal sovereign solution on Neutral Swiss ground, it addresses the technical, economic, and geopolitical challenges of the modern blockchain landscape. It represents a shift towards Swiss precision in an industry often characterized by moving fast and breaking things.

The era of the hobbyist node is ending and the era of the Sovereign Validators has begun.

Technical Reference & Resources