Solana DEX Aggregator Comparison 2026: Carbium vs Jupiter vs Titan vs OKX vs DFlow

Technical comparison of Solana's leading routing engines. How Carbium's 31ms P50 latency compares to Jupiter, Titan, OKX DEX, and DFlow on architecture and execution quality.

Technical benchmark comparison of Solana's leading routing engines, how Carbium's 31ms P50 latency delivers execution quality that traditional aggregators can't match

The Hidden Variable: Where Is Your Quote Actually Computed?

When developers evaluate DEX aggregators, they typically focus on routes, slippage, and fees. What often goes unexamined is geography, the physical distance between your request and the compute that processes it.

Consider the typical CDN-backed API architecture: Your request first reaches an edge node close to you, perhaps 5-10ms away. But that edge node doesn't compute your route. It proxies your request to backend infrastructure that may reside in a completely different region. The response then travels the same path in reverse.

If you're in Europe and the actual quote computation happens in US-based infrastructure, you've added approximately 80-100ms of round-trip latency before seeing a quote. Although likelihood the quote is calculated and Server clusters at Amsterdam or Frankfurt is much more likely. Ob the bottom-line the challenge is that this routing is often opaque, you cannot determine where your quote was actually calculated.

CDN-based distribution is a reasonable approach for serving global retail traffic. But for latency-sensitive applications, arbitrage bots, market makers, professional trading systems, this unpredictability creates execution risk.

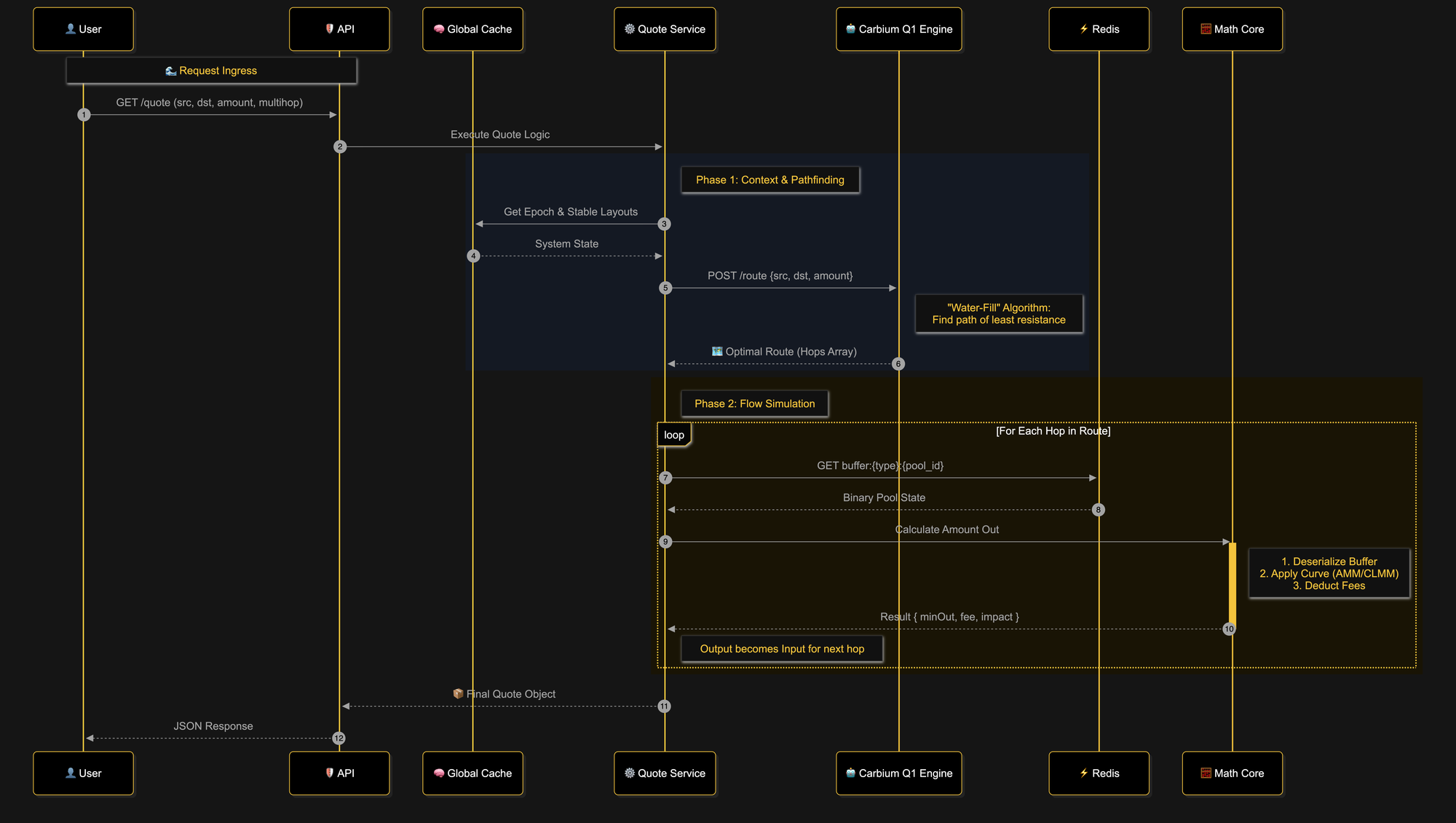

The Binary-State Approach

Carbium's CQ1 Engine takes a fundamentally different approach. Rather than querying external APIs and aggregating responses, CQ1 maintains a binary representation of Solana's DeFi state.

What does this mean in practice? The engine continuously indexes pool states from major AMMs, Raydium, Orca Whirlpool, and others, translating their on-chain data into an optimized binary format. When a quote request arrives, the computation happens locally against this pre-indexed state. There's no external API call, no CDN hop, no uncertainty about where the calculation occurs.

The architecture is described in detail in our CQ1 Engine Architecture post, but the key insight is this: we know what competing aggregators would quote before they even process the request, because we're reading the same underlying pool states, just faster.

The Preview of https://app.carbium.io pathfinding

Benchmark Data: January 2026

Here's what CQ1 delivers in production. For comparison, traditional CDN-backed aggregator APIs typically respond in 250–450ms under normal conditions (based on Carbium testing from Finland, January 2026). This represents an order-of-magnitude difference, not a marginal improvement.

Carbium Quote Generation Performance

| Metric | Value |

|---|---|

| Minimum | 26ms |

| P50 (Median) | 31ms |

| P90 | 38ms |

| Throughput | 27 quotes/sec |

| Target Achievement | 98% under 70ms |

Pool State Fetch Latency

| Pool | Min | Avg | Max | Under 70ms |

|---|---|---|---|---|

| Raydium AMM | 26ms | 31ms | 53ms | 98% |

| Orca Whirlpool | 27ms | 33ms | 41ms | 100% |

(HTTP2 Undici-based quoting)

Five-Way Comparison: The 2026 Routing Landscape

| Aspect | Carbium CQ1 | Jupiter | Titan | OKX DEX | DFlow |

|---|---|---|---|---|---|

| Routing Paradigm | Binary-State Simulation | Metis (Cloud Aggregation) | Meta-Aggregation | DAG Processing | Microstructure Segmentation |

| Engine Name | CQ1 (Waterfill-Split) | Metis | Argos | X Routing | Segmenter |

| Compute Location | Zurich, Switzerland | Global CDN (Compute varies) | Global (Hop Latency) | Centralized | Global (Mempool-based) |

| Quote Latency | P50: 31ms | 250–450ms | Slower | Standard | Fast |

| Execution Focus | Zero-Latency Determinism | Retail UI/UX | Global Minima | Cross-Chain | Toxic Flow Filtering |

Understanding the Trade-offs

Each approach serves different needs. Here's how they differ:

- Meta-Aggregation (Titan) relies on querying other aggregators to compare prices. However, this model has faced significant setbacks as major engines like Jupiter and DFlow have blocked API access for meta-aggregation. To bypass these limitations, Titan has increasingly pivoted to its own RFQ (Request for Quote) engine, sourcing liquidity directly from market makers. While this improves fill reliability, the core "hop latency" remains for any portion of the flow that still relies on aggregating external public APIs.

- CDN-Distributed APIs (Jupiter, OKX) leverage complex backend algorithms to serve global retail traffic, but this computational depth comes at the cost of determinism.

- Jupiter (Metis Algorithm): Jupiter treats the entire Solana liquidity landscape as a massive graph where tokens are nodes and liquidity pools are edges. It utilizes an adaptation of the Bellman-Ford algorithm to traverse this graph, identifying optimal paths by calculating edge weights (price impact and fees). This allows for complex "multi-hop" trades (e.g., SOL → USDC → BONK) and "split trades" (dividing an order across Raydium and Orca). While mathematically robust, this O(V*E) complexity requires significant backend compute, making the physical location of that calculation a variable "black box" for the user.

- OKX DEX (X Routing): OKX employs a Directed Acyclic Graph (DAG) model for its "X Routing" engine. While the specific traversal algorithm is not publicly documented, this DAG structure is essential for modeling complex multi-hop routes across disparate blockchains. A key differentiator is the inclusion of network gas fees as a weighted variable in the pathfinding logic. This suggests a multi-criteria optimization approach (likely involving topological ordering) to minimize the total cost of execution, rather than just price impact.

- Order Flow Auctions (DFlow) segment trades and route them to market makers through an auction mechanism. This can improve execution for certain order types but adds complexity and introduces dependencies on market maker participation.

- Binary-State Indexing (Carbium) trades architectural simplicity for raw speed and accuracy. By maintaining local pool state, CQ1 eliminates external dependencies during quote generation. Specifically, it utilizes a Waterfill-Split algorithm to optimize execution. Instead of sequential graph traversal, this approach treats liquidity pools as containers of varying capacity, filling the lowest-slippage sources first and spilling excess volume to secondary pools in parallel. Since binary-state is the core language of machines, this direct approach bypasses the translation overhead of traditional APIs. The trade-off is the significant infrastructure investment required to keep state synchronized, but this foundation explicitly prepares Carbium for the zero-latency future.

Native Gasless Functionality

While not a central infrastructure component, Carbium also includes native gasless transaction support as a convenient utility feature. This allows users to execute swaps to SOL without holding any SOL beforehand, with the transaction fee deducted seamlessly from the swap output.

Although this is secondary to the engine's core focus on latency, it provides a useful fallback for onboarding flows, spending all SOL on transaction or wallet recovery. Because the functionality is embedded directly in the routing engine rather than attached via a third-party relayer, it remains a consistent and available option for specific user experience needs.

Who Should Use What?

Choose Carbium CQ1 if: You require execution certainty in a zero-sum environment. By leveraging binary-state indexing and the Waterfill-Split algorithm, CQ1 eliminates the "black box" of remote compute, making it the preferred choice for arbitrageurs and institutional algorithms that demand machine-speed responses (31ms P50) rather than human-speed approximations. This is infrastructure built for the zero-latency future, where the computation moves to the data.

Choose Jupiter if: You're building consumer-facing applications where UI experience and route visualization matter more than raw speed. As the ecosystem's first mover and longest-standing aggregator, Jupiter benefits from unparalleled brand recognition and trust. Its interface and ecosystem integrations are mature and well-documented.

Choose Titan if: You want comprehensive price comparison across multiple sources and can tolerate the additional latency that meta-aggregation introduces.

Choose OKX DEX if: Cross-chain functionality is your priority and you're already within the OKX ecosystem.

Choose DFlow if: You're an institutional participant interested in order flow dynamics and market maker relationships.

Conclusion

The DEX aggregator landscape in 2026 has got more complex and isn't no longer about finding a single best option, but more about precisely matching technical architecture to the specific use case. Even using multiple protocols and aggregating standards under one hoof. In an environment where execution speed determines profitability, the focus shifts from general-purpose tools to specialized engines. For applications where every millisecond matters, physical infrastructure and compute locality stop being implementation details and become decisive competitive factors.

Carbium's CQ1 Engine represents one answer to that challenge: eliminate the network uncertainty by bringing the computation to the data, not the data to the computation.

The benchmarks speak for themselves. P50 latency of 31ms. 98% of requests under 70ms. These aren't theoretical numbers, they're production measurements from Swiss infrastructure serving real traffic.

Integrate CQ1 in 5 Minutes

Ready to test the latency difference yourself? Here's a minimal integration to get your first quote from CQ1.

Get a Quote

// Fetch a quote + ready-to-sign transaction for swapping 1 SOL -> USDC

const params = new URLSearchParams({

src_mint: "So11111111111111111111111111111111111111112", // SOL

dst_mint: "EPjFWdd5AufqSSqeM2qN1xzybapC8G4wEGGkZwyTDt1v", // USDC

amount_in: "1000000000", // 1 SOL in lamports

slippage_bps: "50", // 0.5%

user_account: wallet.publicKey.toBase58(), // REQUIRED to receive txn

});

const quoteRes = await fetch(`https://api.carbium.io/api/v2/quote?${params}`, {

headers: { "X-API-KEY": process.env.CARBIUM_API_KEY, "accept": "application/json" },

});

if (!quoteRes.ok) throw new Error(`Quote failed: ${quoteRes.status} ${await quoteRes.text()}`);

const quote = await quoteRes.json();

console.log("Expected out:", quote.destAmountOut);

console.log("Route:", quote.routePlan?.map(r => r.swapInfo?.label ?? r.swap).join(" -> "));

console.log("Has txn:", Boolean(quote.txn));

Execute the Swap

import { Connection, VersionedTransaction, Keypair } from "@solana/web3.js";

import bs58 from "bs58";

const connection = new Connection(process.env.SOLANA_RPC_URL, "confirmed");

const wallet = Keypair.fromSecretKey(bs58.decode(process.env.PRIVATE_KEY));

// Deserialize base64 -> VersionedTransaction

const tx = VersionedTransaction.deserialize(Buffer.from(quote.txn, "base64"));

// Sign and send

tx.sign([wallet]);

const sig = await connection.sendTransaction(tx, { skipPreflight: true, maxRetries: 3 });

console.log("Signature:", sig);

For production integrations including error handling, gasless swaps, and advanced routing options, see the full documentation at:

Learn further how to send transaction with RPC instead of Carbium Swap:

Technical Reference & Resources